The Fed is Done: Beating the market by learning from the past

Exploring monetary policies, inflation, rates and positioning to outperform

As investors, we seek to own a portfolio of stocks (ownership of businesses) trading at a margin of safety, i.e. a price significantly below their fair value.

Where do we search for those equities? One way is the top-down approach. We start by understanding the macro environment to find areas where there is unreasonable pessimism that is more than priced in at current valuations.

We keep in mind that consensus is usually too late as the market is pricing the future while many money managers are reacting to the present. Looking at similar points in the past can help us understand what may unfold.

This post will cover why I believe the Federal Reserve is done raising interest rates, how money managers are positioned, and how we can gain an edge by learning from past cycles and searching for unpopular quality businesses in areas spurned by the market.

In the short run, the market is a voting machine but in the long run, it is a weighing machine ~Benjamin Graham

Post outline:

A quick look at the recent inflation and rates cycle

Two reasons rates are probably going down sooner than people expect

A look at what type of companies are hurt when rates rise

Why these companies offer an appealing opportunity

Short portfolio overview

The Fed is done raising rates

Understanding inflation and interest rates

Why did the Fed even start raising rates?

In 2020 we had the COVID-19 pandemic, which caused both an uptick in demand for goods, as well as global supply issues.

Worldwide, governments feared a recession and employed monetary stimuli, with the US reducing rates to 0% and enacting an unprecedented level of QE.

Quantitative easing (QE) is a monetary policy where central banks buy securities to infuse liquidity into the economy, promoting lending and investment

The pandemic, supply chain issues, monetary policy and later the Russian invasion of Ukraine started an inflation surge that peaked (in the US) at 9.1% in June 2022.

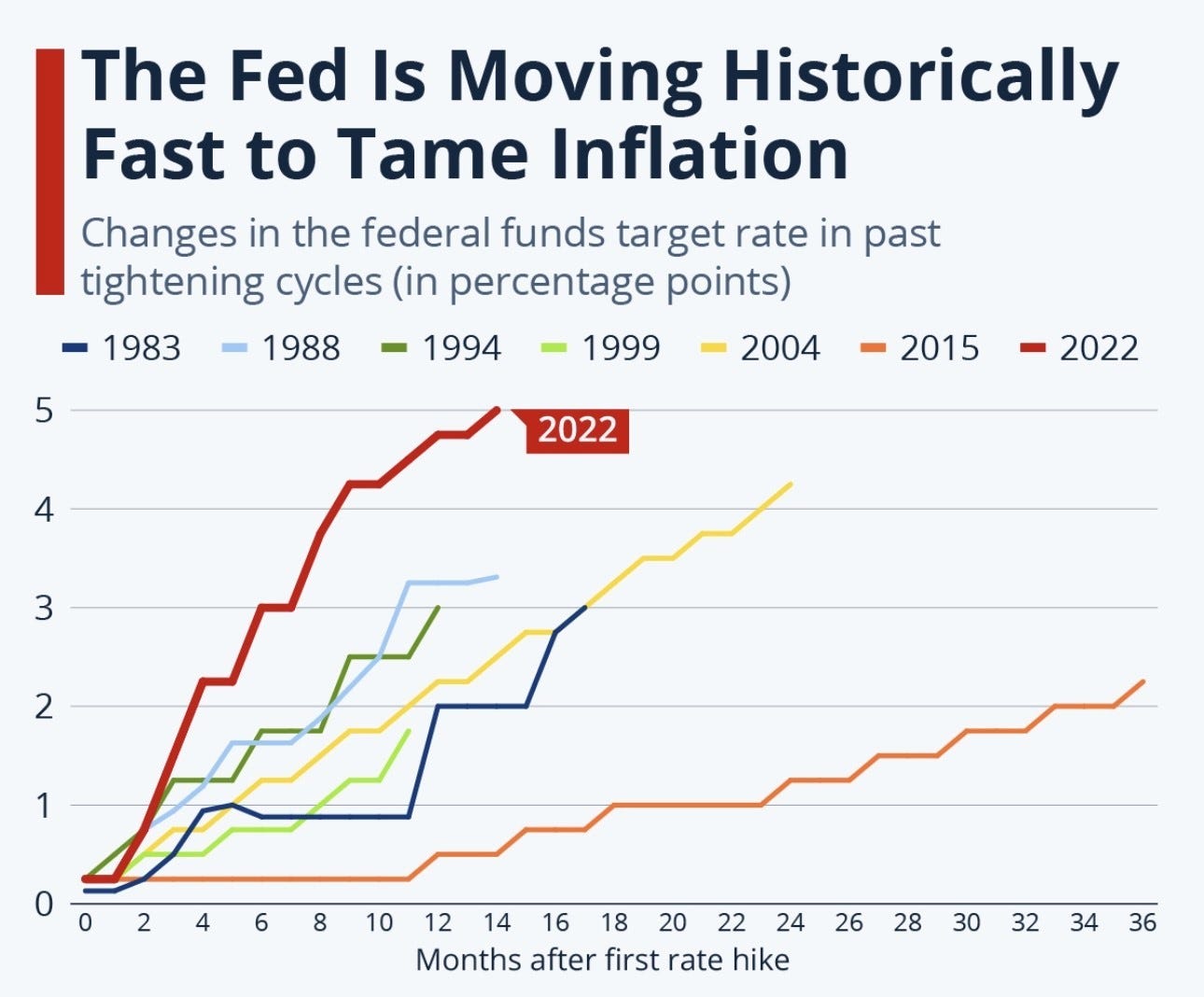

In response, most central banks started hiking rates aggressively at the start of 2022 and the US started shrinking the balance sheet by letting assets mature.

The good news is it seems like it worked!

You might say: “Inflation is nowhere close to the Fed target of 2%”.

Well, you would be missing two things:

Almost all of the current inflation comes from one component: shelter, i.e. the cost of renting/owning a house.

Excluding shelter inflation (35%+ CPI weight), inflation is already below the Fed target

Shelter has already cooled, the Fed is looking at lagging indicators. If we look at rent indexes, they are already down

To sum up:

As inflation is cooling and the Fed continues to employ Quantitative Tightening by shrinking the balance sheet, further rate hikes are unnecessary.

The Fed raising rates is akin to shooting themselves in the foot

The US government debt ballooned in recent years and is the highest it has ever been in relation to GDP.

With debt at all-time highs, every time the Fed hikes rates they raise the annual interest expense on government debt (projected to be more than 10% of US expenditures in 2023) while slowing the economy (GDP).

Also, a large portion of the debt is short-term and 31% matures within a year and will need to be refinanced. The government will struggle to do so at higher rates and will probably need to borrow more or print money, ironically raising inflation.

The Fed has a similar problem. During Covid, the Fed bought a lot of long-term securities at low rates to boost the economy while on the liability side, the Fed is paying interest on reserves. As the Fed hikes rates, its interest expense goes up while the interest income stays locked in at low rates.

As a result, the Fed is operating at a loss for the first time since 1915. There is no risk of solvency as losses are captured as deferred assets.

Wrapping up on rates

While inflation is cooling and the debt burden poses a problem for the government, the Fed projected another rate hike this year and intentions to keep rates “higher for longer”.

We concluded that raising rates is harming the US and the Fed and that it is unnecessary. One then might be confused about the Fed mantra from the last statement of “higher for longer”.

The logical conclusion is that the Fed is bluffing. Expectations for higher rates delay the Dollar's inevitable decline (more on that later) and help manage future inflation expectations as both drive inflation. Expecting higher rates in the future helps curb risk-taking in the present.

I also think a recession seems unlikely at the moment but will leave that for future posts.

Looking back at history, the last time Debt to GDP got this high, the Fed established a cap on yields by committing to buy bonds as needed when the yields got above a certain level. This lowered the cost of capital and provided certainty that helped bring economic expansion and cut down government debt to manageable levels.

Fed futures are pricing a 45% chance for additional 1-2 rate hikes this year (unlikely in my opinion) but a 62.9% probability that the cuts start until July 24 - they see through the Fed's “higher for longer” mantra.

Where do we search for value?

So we know rates have gone up and probably topped. What happens when rates go up? What is now cheap and unpopular?

Here I will give an overview of the type of companies that are hurt by rates rising. As markets are forward-looking, these stocks fell while the S&P500 rallied this year and now presents an opportunity as the market starts pricing its recovery.

Money markets dry up

IPOs stop and valuations of unprofitable companies go down

The cost of debt goes up and refinancing debt becomes harder, especially for smaller and or less profitable companies

Banks profit from higher rates in the long run, but fast hikes threaten their balance sheets as the fixed assets they hold depreciate in value when yields ascend, adversely affecting their balance sheets

Small businesses and real estate companies struggle with refinancing debt and the higher cost of capital

Biotech companies are especially hurt as they are often cash-burning and are reliant on funding in the form of IPOs, private funding rounds, M&A (selling to larger companies), and debt

USD strengthens

Higher rates in the US attract capital inflows from foreign countries with lower real rates

Rising rates increase economic uncertainty and recession probability, influencing many to flock to US Government Bonds that are seen as a safe asset

Companies from emerging markets and domestic companies selling internationally are hurt, as mostly hold USD debt, and pay dividends in USD but earn profits in a foreign currency

Demand goes down

Cyclicals, for example, apparel companies, overstock inventory at high input prices when inflation and demand are high. When rising rates kill demand, they are stuck with excess overpriced inventory

As rates peak, the market will start to price the reversal of these trends.

How managers are positioned

It also helps to have a perspective of what the consensus is. People forget that crashes start when investors are exuberant and invest on margin not when they are in panic.

While the top S&P500 stocks have seen a rally in 2023, biotech, emerging markets, the UK, and many cyclical equities tanked and small-cap value stayed at depressed levels in anticipation of higher rates.

The most crowded trades are still Long Big-Tech and Short China (emerging markets’ largest weight) as investors are backward-looking.

US vs international cycle

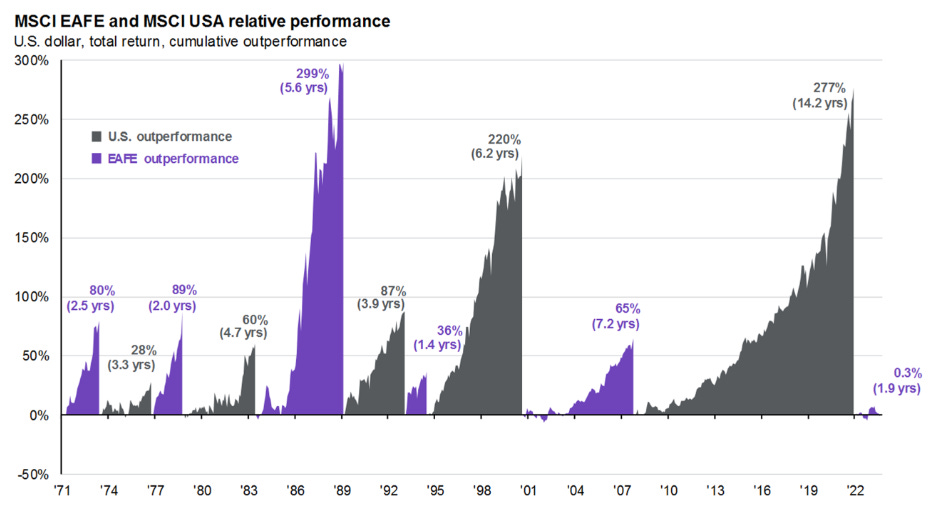

Capital flowed to US securities in the last 14 years or so. It seems that we are on the cusp of a sea change as the dollar trend reverses and US stock valuations are the most expensive in relation to the world in the last 20 years.

In the short term, higher rates attract flows to the Dollar. In the long term, the large U.S. trade deficit will cause the Dollar to decline and the interest rate differential will narrow as the US starts cutting rates.

US stocks are the most expensive they have ever been in relation to the rest of the world since 2003, especially as the Dollar peaks.

We are moving from US outperformance to the next part of the cycle.

In the US there are still equities at attractive levels outside of the big names that are already up.

History - what rallies at the end of rate hike cycles?

History never repeats itself, but it does often rhyme ~Mark Twain

A look at past 2 rate hike cycles paints an interesting picture.

From June 2004 to June 2006 the Fed hiked by 0.25% 17 times. Dec 2015 - Dec 2018 the Fed raised rates 9 times.

In both occurrences, biotech, emerging markets, and small-cap value indexes were depressed in anticipation of the tightening before rallying aggressively for years! During/after both instances the Dollar peaked and trended down.

As we keep in mind the market is pricing the future, these are exactly the areas we look at for discrepancies between price and value!

Also, some cyclicals, especially those that are small, leveraged, and are sifting through excess inventory present attractive turnaround opportunities at current prices.

My current holdings:

Emerging markets: BABA, STNE

Biotech: XBI

High leverage, small, temporarily impaired cyclicals: DLA, CPS, GCI, ASOS.L

Larger companies on sale: PYPL

GCI is a smaller position with asymmetric risk/reward.

Comment if you would like an overview of each position or a deep dive on a specific one.

What next?

In the next posts, I intend to do deep dives on specific positions I own/watch and macro views. Message me if there is a topic you would like to read about.

Data

Most of the data I am basing my view on is found in the Federal Reserve Economic Data, JPM Guide To The Markets, and Bank of America Fund Manager Surveys. I recommend reading those as there is a lot of interesting information I didn’t go into.

Edit: people have messaged me on parts they didn’t fully understand and I have been updating the post. I appreciate it!

Disclaimer: This is an opinion, nothing constitutes professional and/or financial advice. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of the ideas expressed.