Time weighted returns for 2024 were 5.26% vs 24.89% for the S&P.

Year Overview

Crazy year. In the first half had challenges in my personal life and community, made lots of mistakes and entered the second half with a large drawdown.

Things turned around in the second half. Finished my BSc, started a new job, moved out, and refined my investing process. performance recovered in the 2nd half, and started this year strong up 14.78% YTD in January 2025.

In the second half my process changed a lot, putting a larger emphasis on catalysts, less direct betting on macro and firmer limits on options usage and exposure.

What went right

SBBC.V

Original writeup by

, pitched to me by @CuriousinFuture on twitter.At 0.6 CAD it was pretty obvious, private equity guys kick the CEO, sell the non profitable/growing segments, and focus on one brand (Trubar protein bars) that is growing extremely fast, to sell it to a larger CPG company.

Trubar increased store footprint this year from 1.5k to 15k+ and are on way for >100M revenue in the next 18 months (currently breakeven aiming for ~10% EBITDA margin). Past takeouts in the sector were done at 3-5x revenue. After doubling this is still at <90m fully diluted market cap.

The board are experienced (which helps them land deals) and just started advertising, marketing and building the team. There is also potential for international expansion and they are expanding to new retail partners fast.

They also outsource and diversify logistics and manufacturing taking a lot of execution risk off.

We do need to account for 26.5% corporate tax + dividend tax on sale of Trubar.

The chairman said they will look to buy other brands with a small portion of the money while distributing most of it (which is also a negative/added risk as a shareholder). Also expect some warrant dumping pressure in Feb.

It is one of the larger positions of my portfolio as of now. Will likely trim some if it doubles again before the buyout.

A good thread on the investment case

ZOMD.V

Made it a big position at ~0.4 CAD. They were cashflow positive, with a net cash position so no solvency risk. The new CEO refocused the business model and cut costs and I could get in at <3.5X run rate P/E with high top-line growth.

Had short term tailwinds of sports events (olympics, euro, …) in Q3 and the holiday season (e-commerce) in Q4.

Sold out after a double as the client concentration bothered me and didn’t feel the business was as predictable going forward.

Intellego

Had a tracker position for a while to follow this.

This is one of the write-ups I read about it.

Made it a much larger position when they announced 5 year 360m$ collaboration in Nov. Assuming ~20% EBIT and discounting it backwards the business impact was greater than the market cap.

There are problems with bad disclosure, mistakes with financials, and with collecting receivables with this one. I sold most of the position after a large run.

If they show improvement in the conversion of receivables to cashflow or get the Delloite auditing done I might resize the position.

GXO, PYPL

Great businesses that traded at unreasonable valuations. Traded options on both. Still have a position in GXO. Theme was around restocking cycle, talked about it in the past.

Reentered after the CEO announced he is looking for someone to replace him and they decided not to go forward with selling the business.

Paypal had solid growth, low cashflow multiple and high buybacks. The new CEO had a good track record, and the new features looked promising.

GCI

Wrote a note about it in the substack, it worked roughly as I expected and I sold too early, unfortunately.

Mistakes

DLA

Talked about it in a previous update.

Moberg

Failed the phase 3 trials because of bad planning, learned not to try and pick specific biotech companies (unless playing liquidation).

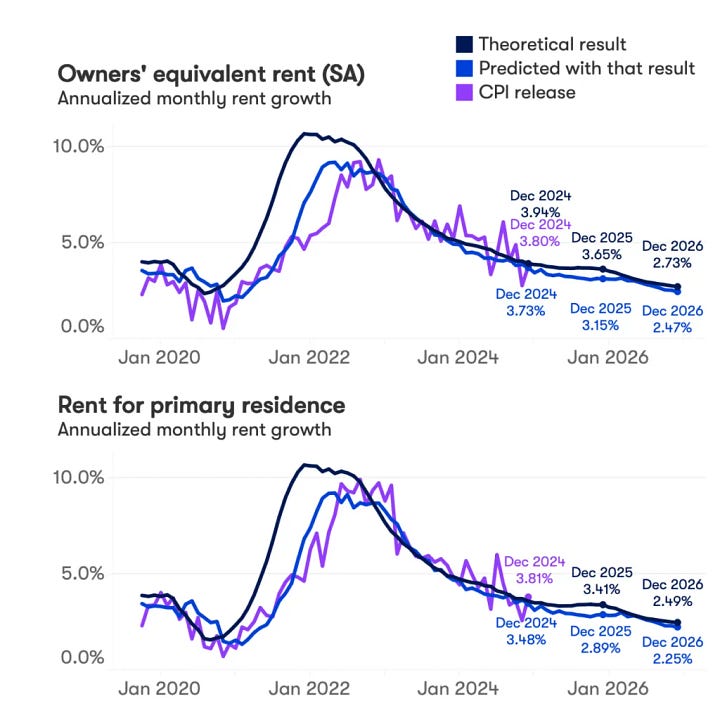

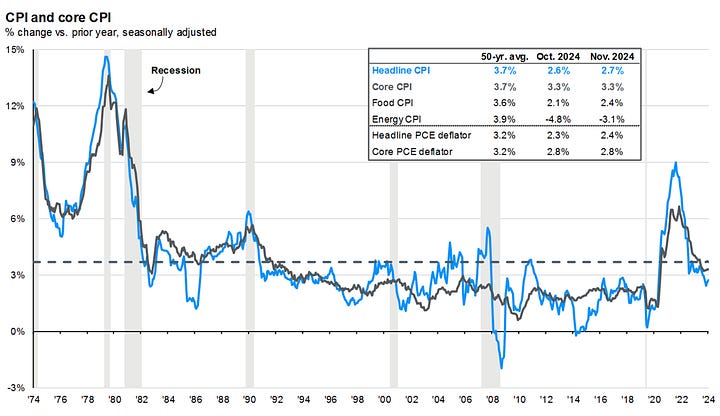

Long term yields and the Dollar

Forecasted correctly that inflation peaked and the Fed would cut while there would be no recession. Didn’t see long bond yields rising while short term yields being cut coming.

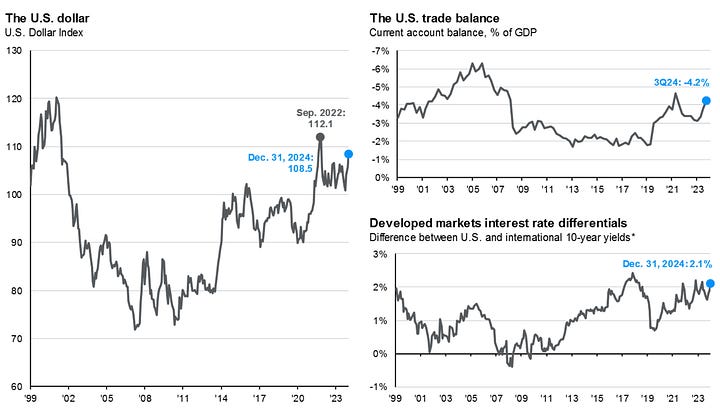

Long term yields were more important for most of my thesis about small caps (as most financing is long term). Missed that the market would be scared of Trump tariffs and expect future inflation because of it, as well as a rush to safety (USD).

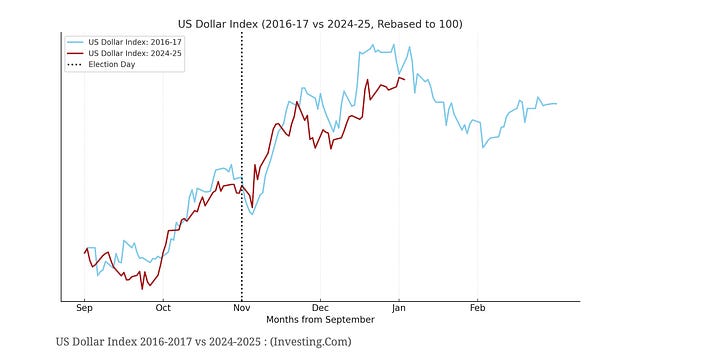

In his previous admin, the market behaved the same, pricing in trade wars. The 10 year and the dollar rose after the election and then went down after he got into office.

Here people expected 60% China tariffs and now Trump says he doesn’t wan’t to tariff china, to be seen but likely less disastrous than expected.

Example for what happens when expectations are extreme: Dollar crashes as Trump stops short of imposing tarrifs

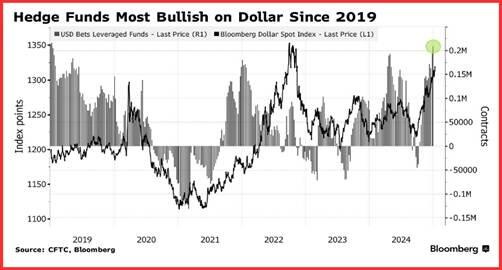

Dollar positioning started this year as crowded as it gets the most likely path is down.

Main lesson here: it is fine to have an opinion about the macro but betting on it directly and getting the timing right is difficult.

China having to defend currency

Just a matter of time but missed the fact that China needed lower US yields for substantial stimulus as they need to defend their currency from interest rate differentials.

STNE and Brazil

Sold of most of the position. Drought, continued government and depreciation of the BRL hurt inflation progress and maintained high interest rates.

The business executed well and bought back shares but the currency and macro environment were terrible. Might start working here soon and I have a small options position to participate.

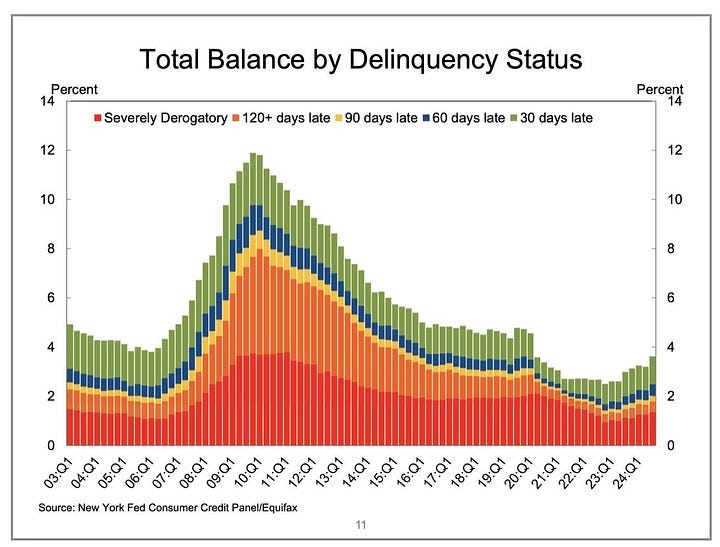

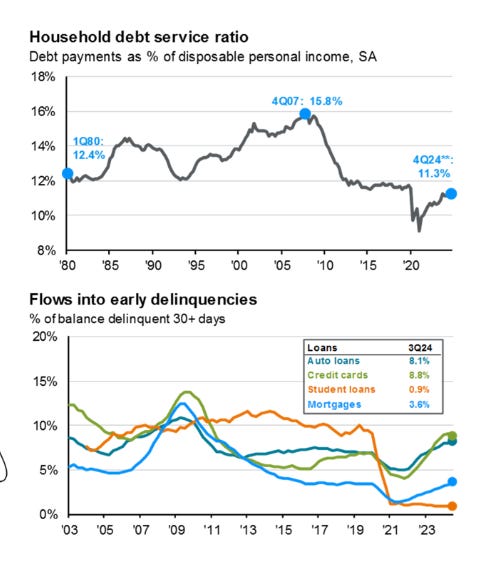

Macro Themes In Pictures

Current Portfolio

Large positions in SBBC, ASPI, BABA.

Medium sized positions in CPS, an undisclosed company.

Small (mostly options) positions in Intellego, GXO, STNE, biotech (XBI), small caps ETF (IWM), TLT.

ASPI

Would recommend reading

posts.Also Some great posts on twitter like this one, and the company's response to a short report. Of course the company presentations are a good place to start research.

In my opinion, both the QLE segment (they are meaning to spin-off) and the medical isotopes business would be worth north of 1B$ in a couple of years making this a great opportunity.

The stock took a hit on the DeepSeek news which made zero sense.

Most of the value IMO is in the medical isotopes business.

Energy need is not going to go down. There are two options:

AI is gonna get cheaper which would make it more accessible and makes demand higher.

People shouldn’t be shocked that distilling current LLMs to a smaller model and adding a couple of tricks is cheaper than trading models from scratch (as well as creating datasets and benchmarks).

US large tech probably has room to improve efficiency in both scenarios.

CPS

Light vehicle sales are trending up and finished 2024 strong with 16.5M and 16.8M for nov, dec.

January is seasonally weak but looks on track for solid YoY growth. This sets up for a great second half.

On the other hand, production is still likely gonna stay subdued in the 1st half (working through high inventories) and tariffs are a major threat as a lot of their production is in Mexico/Canada/China.

Also higher long term yields make it less likely they refinance their high rate debt in the first quarter.

For these reasons I recently reduced the sizing significantly to <10%. Still could 10x if tariffs end up soft but no need for me to bear risk.

Written more on this lately.

Baba/China

Talked about this a lot. New news are: Trump would rather not put tariffs on China

Also recently the DeepSeek news. Baba later published their own cheap model that outperforms all open source models to date. The market ascribes no value to the fact AliBaba hold equity in all of China’s AI startups and had the largest supply of GPUs in China.

The BOJ rate hike should pressure the Dollar (carry trade) and is helpful for China exports (and allows some room for further stimulus).

I remain extremely bullish this theme for 2025. Especially as many of the cash burning segments breakeven and the macro thesis plays out.

Some of the infographics are from “J.P. Morgan Guide To The Markets”

Not financial advice, just my investing journal.